|

Flow Research

has nearly completed a new study on the worldwide

Coriolis flowmeter market, one of the fastest growing flowmeter markets,

and this groundbreaking new study reveals the size of the 2024

worldwide Coriolis

flowmeter market, including the market shares of all major suppliers and

forecasts for the market through 2029.

The World

Market for Coriolis Flowmeters, 8th Edition

builds on studies Flow Research published in 2001,  2003,

2008, 2013, 2016, 2020, and 2023. We are determining: 2003,

2008, 2013, 2016, 2020, and 2023. We are determining:

Worldwide supplier market size and shares for Coriolis flowmeters in

2024

Market growth forecast through 2029

Industries and applications where Coriolis flowmeters are used,

including market growth sectors

Strategies for manufacturers for selling into the Coriolis flowmeter

market

Company profiles and product analysis for the main Coriolis suppliers

Product descriptions and average selling prices in the market

The popular

Coriolis flowmeter requires little maintenance and is highly accurate --

many Coriolis flowmeters achieve 0.1% or even 0.05% accuracy. In addition, Coriolis

flowmeters can measure mass flow, which is useful for products sold by

weight rather than by volume and for chemical reactions that are based on

mass rather than volume. Process plants are increasingly selecting Coriolis

meters to replace differential pressure (DP) devices. Mass flow is

especially appropriate for measuring gases, which are more readily affected

by temperature and pressure than are liquids, and their use is growing in

the oil & gas industry.

Companies

that need flowmeters for custody transfer, or want highly accurate

measurement of mass, have a good reason to select Coriolis flow meters. They find that despite a relatively high price tag,

Coriolis flowmeters can provide a good return on investment.

How they work

The roots of

todays Coriolis flowmeters can be traced back to the 1950s. This study

includes a review of the early patents filed in the 1950s, 1960s, and

1970s. it was not until 1977 that Micro Motion was founded and soon

afterwards introduced the first Coriolis flowmeter for laboratory applications. Since that time, a number of other suppliers have

entered the market, including Endress+Hauser, KROHNE, Yokogawa, Rheonik,

and ABB and have

introduced a wide variety of models and types of Coriolis flowmeters.

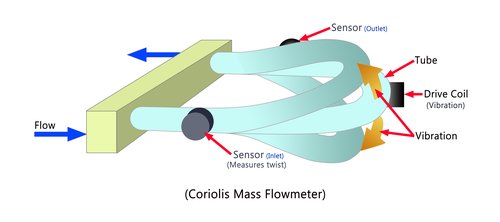

Coriolis

flowmeters contain one or more oscillating tubes. These tubes are usually

bent, although straight-tube meters are also available now. The fluid to be

measured passes through the oscillating tubes. The momentum of the fluid

deflects the oscillating tubes. Pickoff coils passing through a magnetic field generate a sine wave

on the inlet side and the outlet side. The phase shift or time difference

between the defection in the tubes on the inlet and outlet sides is directly proportional to

mass flow.

Why the Coriolis market is growing fast

A number of

factors are contributing to the growth in the Coriolis flowmeter market:

Custody

Transfer. Custody transfer of natural gas is a fast-growing market,

especially with the increased popularity of natural gas as an energy

source, and Coriolis flowmeters are feeling the effects. Natural gas

changes hands, or ownership, at a number of transfer points between the

producer and the end-user. These custody transfer points are tightly

regulated by standards groups such as the American Gas Association (AGA),

which approved a report on the use of Coriolis flowmeters for custody

transfer of natural gas in 2003. This report, AGA-11, has provided a

significant boost to the use of Coriolis flowmeters for natural gas flow

measurement. The majority of Coriolis suppliers now have meters that can

measure gas flow.

In addition,

suppliers have made a number of improvements in Coriolis technology, and

Coriolis meters are now much better able to measure gases.

Technological

improvements

Suppliers continue to make

technological improvements in Coriolis flowmeters. Straight tube meters

have become more accurate and reliable, thereby addressing some of the

drawbacks of bent tube meters, including pressure drop, the inability to

measure high-speed fluids, and the tendency of bent tubes to cause fluid

build-up.

While bent tube meters still have advantages over many conventional

meters, they do introduce pressure drop into the system. Pressure drop is

an issue because in many cases the fluid has to be speeded up back to its

original velocity. This costs money, as it requires the use of pumps.

Another issue has to do with the tendency for build-up to occur around pipe

curvatures. This can be a special problem for sanitary applications. Having

a bent pipe also slows down the fluid, making it more difficult to meter

high-velocity fluids.

Other

improvements include the use of titanium and other construction materials

that make the meters stronger and longer lasting, as well as a trend toward

flowmeters that can effectively handle larger line sizes. More than any

other meter, Coriolis meters have line-size limitations. Due to the nature

of the technology, Coriolis meters get large and unwieldy once they reach

the six-inch size. Even two-inch, three-inch, and four-inch meters are

quite large. Rheonik has combined two six-inch Coriolis meters to create a

meter that can handle larger line sizes. While it has sold a very limited

number of these meters, it does represent an interesting and creative way

to deal with the line-size issue. Other companies that have introduced

Coriolis flowmeters for line sizes above six inches include Endress+Hauser,

KROHNE, Micro Motion, and Shanghai Yinuo.

Low

maintenance. Even though Coriolis meters have a higher purchase price than many other flowmeters, they may cost less

over the lifetime of the meter due to reduced maintenance costs. Unlike

turbine and positive displacement meters, Coriolis meters do not have any

moving parts, apart from the vibrating tube. They are not subject to wear

in the way that orifice plates are. With many companies reducing their

engineering and maintenance staffs, having a meter that does not require a

great deal of maintenance can be a major advantage.

Lower cost

meters. Micro

Motion, Endress+Hauser, and other companies have broken the price barrier, by offering lower-cost

Coriolis meters in the $4,000 range rather than the more typical

$9,000 to $12,000 range and up (depending on size). The lower price also

means lower accuracy -- published accuracies are in the 0.5% range -- but

these meters give end-users the option to buy into the advantages of

Coriolis technology at a more affordable pricepoint..

Articles about Coriolis

flowmeters

Previous

studies:

T

he

World Market for Coriolis Flowmeters,

7th Edition

Released in 2023

T

he

World Market for Coriolis Flowmeters,

6th Edition

Released in 2020

The

World Market for Coriolis Flowmeters,

5th Edition

Released in 2016

The

World Market for Coriolis Flowmeters,

4th Edition

Released in 2013 - Provides historical context

The

World Market for Coriolis Flowmeters, 3rd Edition

Released in 2008 - Provides historical context

The

World Market for Coriolis Flowmeters, 2nd Edition

Released in 2003 - Provides historical context

The

World Market for Coriolis Flowmeters, 1st Edition

Released in 2001 - Provides historical perspective

|